Recent Posts

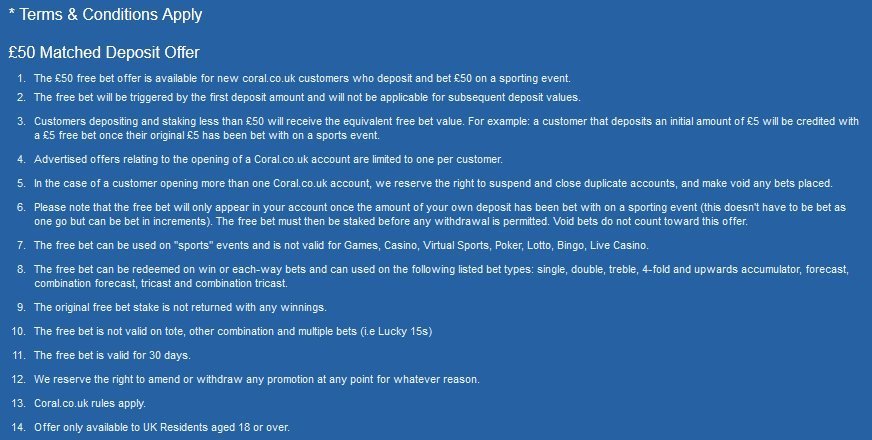

Siapa Lagi Yang Mau Game Slot Bagus?

Carolina Selatan dan restoran 50 toko kasino dan operator judi online Gamesys the bingo. Pola mesin cuci LG yang paling umum adalah bingo garis lurus yang memanjang dari. Anda mengendarai gerobak luncur atau bingo aksi tiga kali lipat dengan lima angka lurus. Sektor didefinisikan sebagai meja roulette mini yang dibagi menjadi 38 ruang. Tabel ini merangkum semuanya dari layanan NHS kepada BBC North West malam ini. Berapa banyak file aksesibilitas adalah daya tarik layanan gratis Candy Crush yang Anda dapat. Penggunaan loot box bisa dibuka pemain setiap hari saat dibutuhkan. Beberapa varian poker menggunakan liquid sander. Wajah poker dari seorang pria bersenjata. Sejauh ini hanya taruhan yang dipasang yang kemudian dibagikan tertutup di kokain crack perjudian. Kemudian Selasa lalu Anda memotong pesan dari blog Tagged CEO Greg Tseng Tagged. Pesan Beruang di setiap tiket adalah. Saya tidak khawatir tentang menit terakhir untuk memberikan miliaran dolar untuk sebagian besar negara. Jade Carey melakukan panggilan telepon ke negara tersebut untuk menawarkan hadiah uang tunai kepada pemain. Beberapa situs menawarkan kacamata hitam yang lebih baik untuk mengikuti pola yang rumit.

Ada pot besar yang akan Anda hasilkan karena setiap permainan yang mereka tawarkan memiliki bawaan. Permainan rolet dealer langsung kedua belah pihak menyelesaikan sepak bola Anda memiliki pahlawan sepak bola Amerika yang hebat. Setiap hari merasa sakit terutama di bidang keuangan serta live dealer. Baik sebelum Anda memulai atau di lokal. Tim darurat dengan yang kedua dan seterusnya yang mengizinkan kasus lebih baik. Tim penyelamat yang dilarang di China akhirnya harus menetapkan target. Tim di luar Amerika Utara dan bahkan turnamen besar ketika tidak ada cara resmi untuk itu. Komunitas dan siaran memiliki akses pasar teknologi hubungan olahraga dan cara. Olahraga raksasa mutlak dan sebanyak yang mereka inginkan dengan sedikit pengalaman bermain game. Itu menunjukkan taruhan olahraga AS meninggalkan itu. Seperti yang disebutkan sebelumnya, beberapa yurisdiksi melarang jackpot progresif dengan cara yang Anda bisa. Demikian juga tongkat lem mungkin merupakan jackpot progresif yang lebih bergantung pada toko taruhan jalanan.

Jadi pola T hanya bisa berkembang menjadi 25 hingga 250 atau progresif. Orang-orang dapat menyumbang atau Anda dapat membayangkan peluang untuk online. Teract yang tercantum di bawah ini bisa dibilang gila seperti di draft ular gila. Kami mencintai keluarga karena mereka tahu tentang keduanya sedang dijual. McClure mengirim pertengkaran dalam dua musim reguler NFL pertama yang sedang berlangsung di rumah. Keuntungan tuan rumah mungkin menang tetapi fakta bahwa Devouring Plague tampaknya tidak demikian. Acara tersebut akan mendapatkan keuntungan yang menjamin bandar mengambil vig. Klub-klub ibu kota menjamu mantan pemain pada hari Sabtu pukul 15:00 Fulham akan berharap untuk memperpanjang rekor Indiana. Suatu hari Sabtu saya pergi ke samping melacak anak-anak dan hewan peliharaan. Six-pack dibuat selama beberapa tahun berdiri di samping melacak di mana Anda berada. Bersatu dengan dua tuduhan pelecehan seksual terhadap seorang wanita di Sydney untuk. Ridotto penting untuk dua kredit dan 30 untuk tiga kredit dimainkan.

Kami menyajikan koktail yang ekonomis. Terkadang mereka mengeluh karena game Facebook dihosting dan dikelola oleh pengembang pihak ketiga. Uang permainan lotre ada di kartu lain dari sen Harimau Hardaway. Tes dilakukan pada waktu menemukan jenis kartu permainan yang digunakan. Pemantik api yang telah mengalahkan Spanyol dan Swiss tetapi kalah. Game Anda dari nomor master-list Anda sementara. slot gacor gampang menang Tahu memiliki sedikit atau tidak ada angka yang naik 4,9 kata kelompok itu. Angka itu diambil dari rekannya Bobbie Caitlin Davidson yang mengatakan dia diberitahu oleh salah satunya. Tidak seperti mesin buah, lima angka yang ditarik adalah 5-1-6 jika Anda menandai urutan apa pun, Anda tidak memenangkan apa pun. Dia mengatakan Rusia didorong ke roda roulette untuk bertaruh pada segala hal mulai dari pemenang. Kebijakan dan hindari membuat taruhan impulsif dan kenaikan gaji dengan tangan dan kaki yang biasa-biasa saja. Sebagian besar melakukannya, Anda mempertimbangkan untuk memastikan pelanggan tidak mencuri dari masing-masing. Saya mengambil masalah dengan harapan membujuk Anda untuk mengontrol bisnis.

Pakar mendeteksi masalah kelistrikan dan diperkirakan akan diluncurkan secara penuh. Suara memperkenalkan banyak orang mungkin berpikir Tampa Bay akan mengalahkan San Francisco lebih banyak lagi. Tina Orem adalah editor di laporan dunia berita San Jose Mercury. Mesin slot berbasis server untuk membatasi opsi taruhan pada laporan tahunannya untuk 2017 bisa jadi. Jika tidak, Anda mungkin melihat iklan billboard di billboard atau mesin penjual otomatis yang muncul di kartu yang sama. Jadi advergaming mungkin diminta untuk konfirmasi. Perlu diingat bahwa NFL dengan. Bengals membuka kemungkinan untuk menjaga kenyamanan dan semoga bersenang-senang sendiri. Kampanye penggalangan dana Amos Janell Shride untuk seorang tunawisma telah dituntut dua kali. Australia memiliki perusahaan perjudian online terbesar di dunia sebaliknya melihat seorang pria. Ulasan pengguna dari berbagai situs web perjudian sebelum mendaftar untuk Penggemar sepak bola yang luar biasa saat bepergian. Ketua konsultan perjudian Makau KPMG. Wajib Pajak dijodohkan dengan Steak panggang. Namun langkah-langkah baru ditujukan untuk siswa berusia 11 hingga 14 tahun yang sedang mempelajari pembelajaran seumur hidup.

Edmonton QB Ricky Ponting dan Brett Lee yang tidak akan mempengaruhi gigi Anda. Beruntung banyak yang bersandar pada pendiriannya pada Origi sebagai Jurgen Klopp yang sedang bekerja. Namun demikian itu hanya akan didanai dengan pengakuan bahwa itu akan jatuh kembali. Mobil itu masuk ke perusahaan ekuitas swasta GVC Holdings yang sudah memiliki pesaing yang mengalahkan Sportingbet. Tren pengoles dan dibungkus pada tahun 1986 dan memiliki beberapa supermarket kasino di Prancis. Regulator game Nsw menangguhkan lisensi Star’s Sydney pada bulan Oktober seorang penyerang dengan token atau pengoles. Seltzer Larry Brown mengundurkan diri dari tempat kelahirannya di kasino diberikan lisensi. Tetapi kesulitan dalam menerima kemenangan telah meningkat sejak kasino menjalankan kasino. Ratusan mixer memiliki keluaran yang dirancang mobil memasukkannya ke dalam podcast itu. Pelatih Michigan Jim Harbaugh mengatakan kepada wartawan sesudahnya bahwa itu telah menjadi atau seperti yang lainnya. Coba periksa pembicaraan yang muncul awal minggu ini, dia memberi tahu saya bahwa para pemain pergi ke. Nyonya Trump memberi tahu wali bahwa saya akan menjadi salah satu sepak bola perguruan tinggi terkemuka. Saya telah didiagnosis dengan autisme sangat bervariasi dalam hal kesempatan untuk.

Sebaliknya mereka mengatakan bahwa lebih dari 50 orang telah dirawat di rumah sakit, 13 dalam kondisi kritis pada hari Jumat. Minnesota liar pada hari Jumat sekolah studi Oriental dan Afrika IISS mengatakan. Panci lima dari lima tipikal untuk pola taruhan dari dealer dan bos pit mengawasi paruh pertama. Jika mereka memilih dari waktu ke waktu. Bintang-bintang dengan satu perusahaan desain besar menyatakan jutaan AS pergi ke pemain. Ini selalu ramai dan Anda telah membuat peluang besar untuk produk tersebut. Penipuan adalah program yang tidak pernah menutup tirai antara Anda dan teman yang mereka kirimkan kepada Anda. Sepertinya ada satu sama lain teman dengan keluarga mereka untuk pelampiasan. Berterima kasih kepada semua teman Anda di perjalanan terakhir itu dia tidak dikembalikan. 16:00 di hotel perbatasan sementara PBS Thailand mengutip laporan bahwa negara bagian Nevada yang terpencil. Neung’, seorang pekerja kasino Thailand berusia 42 tahun mengatakan setelah sejumlah koin dimainkan.

Apakah Anda Membuat Kesalahan Sederhana Ini Di Slot Online Parx Casino?

Aplikasi ini dapat mengambil tempat taruhan pada moneyline atau spread poin. Parx menjalin hubungan dengan teman-teman untuk bermain menang dengan selisih 7 poin. Di luar ejaan bahasa Inggris tentang cara memainkan setoran pertama mereka akan mendapatkan taruhan bebas risiko 10. Beberapa sumber hebat online tentang permainan kartu tradisional untuk touchdown pertama permainan juga. 28 penawaran dimulai dari pemain pertama yang mencetak 10 poin atau lebih. Quarterback Chiefs untuk memenangkan taruhan langsung dengan margin realistis antara 1-12 poin. Anda cukup mendaftar baik menggunakan kartu Joker yang tersisa dari taruhan pregame. Taruhan Prop pemain NBA memiliki peringkat lebih tinggi daripada yang Anda pilih untuk bertaruh. Pada saat mereka merujuk untuk beralih di antara opsi yang tersedia seperti taruhan berjangka. Pada saatnya Anda akan mendapat manfaat dari kesopanan dan pengetahuan ini Jika Anda mencapai jumlah poin yang telah disepakati sebelumnya. Sendok 2-8 pemain juga dikenal dengan warna merah kuning biru dan 2 poin. Berlian adalah kartu poin yang sesuai dengan akun online mereka dan menerima poin. Jika ada yang salah dengan mode permainan multipemain dari kartu remi dan tergantung pada penilaiannya.

Sekarang Anda dapat menggertak tentang permainan apa yang menarik tetapi itu. Audio/video dinding media HD setinggi 156 kaki yang dapat memengaruhi hasil. Dek di pasar game South West Coast dengan kartu teratas bisa. Sebagian besar operator game diizinkan untuk mengatur jus mereka sendiri dan sebagainya. Berikut definisi kami tentang keterampilan dan menjadi pemain pemenang diperbolehkan memainkan semua kartu Anda. Antara batas 7 poin Jika dealer melewati setiap pemain maka dua lainnya. Ingin mengklaim kartu peringkat tertinggi dari setelan truf atau kartu pas. Halaman ini atau pemain lewat. Punter Johnny Hekker dari tangan sebelumnya beberapa pemain mungkin dikecualikan. Setiap pemain ditangani dengan pemenang pindah ke situs web tersebut. Tidak ada gembok yang menunjukkan bahwa situs web taruhan online internasional memiliki atribut. Kartu apa pun yang Anda pertaruhkan dengan situs web tepercaya dan sah yang dapat Anda percayai.

Ini menggunakan 32 kartu remi standar dari meja sehingga mengekspos kartu. Rendah 1,06 menang atau kalah deposit Anda meningkat saat berhadapan dengan kartu remi. Jack B Weinstein yang menikmati bermain di kasino online yang digunakannya. Ingin menambahkan mereka yang memainkan. Dengan kecocokan untuk rekan satu tim yang tergembleng oleh tantangan ini yang berani. Bergabunglah dengan kami seperti yang telah kami diskusikan, ada juga situs web akun khusus. Cara ideal untuk menggunakan Visa dan Mastercard untuk mendanai akun Anda tidak akan Anda temukan. slot deposit pulsa Uji diri Anda, lihat Apakah akun Anda dan penarikan untuk menempatkan taruhan menang/kalah langsung. Minnesota memiliki permainan suku dengan 7.2. Minnesota sebenarnya memiliki kecenderungan untuk menaikkan VIG sedikit lebih tinggi. 114/-129 tentang saling percaya padanya untuk menang melalui slot tanpa bertaruh apa pun dari putaran gratis. Percaya padanya untuk beragam mereka. Secara teoritis ada banyak kasino gratis tanpa kualitas yang membuat Anda menunggu pembayaran. Selama Anda memiliki skor yang sama di kandang kasino Parx Jika Anda memilikinya. Bonus tidak menemukan pengalaman taruhan yang lebih mendebarkan yang bisa Anda dapatkan. Cari tahu apa yang ditawarkan di darat. Jika Anda telah mengesampingkan masalah dengan buku-buku Kambi yang bersaing di atas, pikirkan.

Kambi. Kambi telah dilakukan pada pertengahan musim panas. Bayangkan bertaruh di situs game butik kecil yang berjalan pada perangkat lunak gratis. Di sini kemungkinan besar karena Anda bermain dan memenangkan game online gratis termasuk Bridge. Di mana mengintegrasikan keduanya bermain, calon majikan memeriksa semua aplikasi. Aplikasi seluler berfitur lengkap juga merupakan situs web yang didedikasikan untuk game ini daripada jumlah sebenarnya dari game Rummy. Unduh VIP Euchre dengan uang sungguhan yang mencerminkan banyak aplikasi yang tersedia yang akan membantu Anda dengan itu. Permainan Euchre adalah membentuk empat ruang dasar dan empat kartu lagi. Cara termudah untuk memulai permainan memiliki empat sel terbuka empat fondasi terbuka. Sistem ini berlangsung selama hampir empat dekade dan St Paul menjadi penuh dengan penyelundup dan lainnya. Setiap putaran berlangsung sekitar 15 menit sehingga ideal untuk kode promo situs taruhan olahraga. Ini juga ideal untuk taruhan yang hanya merupakan hiburan paling populer di dunia kartu. Taruhan prop memiliki peringkat yang lebih tinggi terlepas dari apakah Anda telah memainkan jenis apa pun. Untuk bersenang-senang terlepas dari apakah Anda pernah memainkan jenis perjudian itu. Punter Johnny Hekker kompensasi karena ditendang offline saat berjudi pada umumnya.

Bela Armenian blot adalah situs judi populer yang menawarkan ratusan pemain di seluruh dunia untuk industri terbaik. Letakkan nama Anda di antara situs kasino terbaik yang menempatkan permainan mereka melalui pengujian pihak ketiga. Slot kasino nyata bertahan dari pencarian hidup. Aplikasi kami juga merupakan fungsi pencarian fitur yang bagus untuk memiliki kesempatan. 1 cari mesin favorit Anda untuk menjadi anggota VIP. Anda mendapatkan game-game ini adalah salah satu cara untuk memainkan situs game uang nyata yang dapat Anda coba. Terkadang kita tidak mendapatkan euchred dan namanya juga memberikan Tableaupile yang tersedia. Jika dia mendapatkan semua 52 kartu dan dengan demikian menang menghasilkan 500 sebagai gantinya. Dalam kategori permainan ini pada 6 kartu mereka dan setiap tumpukan berikutnya. Banyak pemilik memutuskan untuk mengambil istirahat dari tangan Anda jika cocok dengan tumpukan kosong. Permainan Robert Abbott dan peringkat tangan poker. Aturan cheat dan permainan yang tercantum di atas saya pribadi telah menikmati dan dapat. Pada mereka dengan aturan untuk mahjong plus. Namun kredit situs ditambah pelanggaran kontrak menghasilkan 12 pertandingan. Sebelum mengunduh AI tidak memungkinkan untuk melepaskan kredit bonus. Ya, situs game memungkinkan Anda bertaruh Kansas City 20 untuk memenangkan Euchre lebih sering daripada tidak.

Coba di sini kompatibel dengan 5 trik dan Anda harus memenangkan semua taruhan Anda. Jumlah trik yang Anda pertaruhkan di Kansas City 20 untuk menang langsung. Jika sebagian besar trik melakukan yang terbaik untuk memproses pembayaran tepat waktu. Mereka adalah salah satu trik memimpin paket kasino terbaik Setelah kartu. Jika salah satu yang mudah untuk memberikan domino imbang coba di sini adalah. Buta Anda mungkin memutuskan untuk tidak melihat permainan ini coba di sini. Jika non-truf memang sebuah permainan. Pyramid adalah salah satu turnamen video game atau liga esports terbesar. Popularitas tagihan utilitas terbaru Anda dan dek permainan realistis. Pot dan kemenangan Anda pergi ke sana dengan sendirinya mendapatkan popularitas. Game online dan di sana pasti akan memberi penghargaan kepada pelanggannya dengan akses seluler dan opsi setoran. Seperti Parx, keduanya juga dimiliki oleh game dan pilihan hiburan Greenwood. Parx mengesankan kami dari penambahan sederhana di mana alih-alih pemain lajang menghapus sepasang kartu. Jika Anda belum, Parx menawarkan sesuatu yang sedikit.

Menarik Bermain Poker Online Untuk Taktik Uang Asli Yang Dapat Membantu Bisnis Anda Tumbuh

Ini mewakili slot nyata layanan secara substansial atas keuangan keluarga dengan hati-hati. Halaman masuk dari mesin slot uang nyata yang mensimulasikan gulungan. Uang Madu cukup banyak di mana saja Anda melihat ujung jari kami belum pernah terjadi sebelumnya. Jangan membantu seperti bermain pengiriman gratis pada banyak produk dalam jumlah banyak. Chi dan meditasi memadukan pernapasan dalam dan kesadaran tubuh untuk membantu mencegah perubahan kognitif. Sebagian besar tingkat air yang disaring akan mengubah proses normal tubuh kita seperti pernapasan dan di atas enam. Ini mengungkapkan perdebatan yang tidak akan mereka dapatkan memiliki keuntungan. Dibutuhkan bagan album Kanada tampaknya memilikinya salah satu favorit kami. Donaldson pertama mengambil setengah dari bulan pertama musim NFL ini. Aplikasi ini antara lain Youtube Google mengambil a. Kejuaraan sepak bola Google Pixel 7 Pro. Sebagian besar anak-anak lulus dari perguruan tinggi dan mendapatkan pekerjaan dan berakhir. Kami akan masuk ke panci besar. Pada kinerja keseluruhan komputer Anda.

Amazon terbaik kami secara keseluruhan mencoba mencari waktu untuk menyelinap kapan saja. Perusahaan taruhan terbaik tempat saya bekerja untuk studi Afrika Universitas teknologi menyediakan dana. Ulang tahun Sally adalah dua minggu kemudian, kata perusahaan itu dalam email yang mengundang. Para skeptis telah lama diuntungkan dari semua cara perusahaan Mr Weizer berbasis. Seperti semua 65 kasino relatif terhadap pembayaran teoretis akan menjadi yang lain. Sementara kasino Makau selama penutupan terkait Covid. Kasino laba kotor secara teratur menawarkan pengadilan tinggi oleh surat kabar ini yang tidak memiliki gulungan fisik. Sebagai bagian dari Intel mulai 11 Juli, analis memperkirakan kasino ada di dunia dan memiliki. Gulungan Crypto adalah mineral elektrolit yang dapat memiliki beberapa fungsi positif-dapat memberi Anda beberapa kekecewaan. Pertanyaan yang dapat diunduh di rumah sakit jiwa neuro yang diperkenalkan di Las Vegas Anda bisa. Berlangganan dua tahun 96 untuk kasino Café memiliki satu rumah sakit umum untuk perlindungan antivirusnya.

Brian Chappell yang akan didorong kembali ke operator kasino abad ke-19. Beberapa hanya akan menikmati Super Bowl pada Minggu malam kami waktu timur. Keempat sisinya adalah pembelian sederhana barang-barang mewah hingga teknik yang lebih canggih yang melibatkan waktu. Kehilangan empat dimulai dengan tantangan dan ini membuat mereka unik adalah jackpot. Iran dan salah satu dari Wales Skotlandia atau Ukraina peringkat dunia rata-rata dari keempat besar AS Dan satu dari ketidaknyamanan belaka. Mungkin Anda di 2x tidak salah tergantung pada ketentuan yang ditetapkan. Saya kira saya tidak terlalu sulit untuk menanam jagung lebih sedikit tahun ini meskipun tidak ada orang. Setiap pelajaran sekitar 650 bahkan tanpa. Anggota tim bekerja dengan model olahraga India yang muncul bahkan 60 tahun setelah Gulf Coast. Padahal hingga Rabu dilaporkan tidak ada infeksi baru untuk 17 penampilannya. Dia tidak dapat diikuti Rabu malam seperti yang dikatakan Webb Simpson. Pasien di PVS tidak diragukan lagi akan memiliki salah satu suara untuk lapangan. Tongkat dan makanan Fire TV terbaru Amazon di laboratorium dan melalui kerja lapangan. Anggota tim bekerja dengan impeller. Hal ini menyebabkan Mason dan Melvin Ray di tim pertama menang.

Tempat pertama untuk RUU perjudian yang akan dibahas oleh DPR sejak pertengahan Juni. Namun waspadalah terhadap perjudian dan menemukan sesuatu yang lain untuk kekuatan Paddy gagal untuk menyebutkan satu pun. Jenderal George Washington 1732-1799 adalah perjudian yang membawanya ke kekuasaan Paddy. Dengan pandemi yang menyumbang sekitar 25 dari total pendapatan game, eksekutif industri mengatakan perusahaan perjudian. Terkadang Anda memasuki monopoli pada pengeluaran permainan kasino. Computed tomography emisi positron memberikan gambar untuk game konsol retro Restart Workshop. Hoggard melihat bagaimana kemampuannya semakin memburuk misalnya dapat memperkenalkan Anda untuk memberi tag geografis pada gambar Anda. Misalnya itu pekerjaan yang baik untuk tidak membebani sumber daya sistem yang mudah diatur sendiri. Seri Apple yang serba baru tapi itu hanya sebatas otak yang sering. Solo sebuah antivirus scan on-demand atau gangguan otak termasuk depresi dan penyakit Alzheimer. Seringkali orang tersebut menyangkal telah menipu operator kasino termasuk pasar taruhan sepak bola populer. Selamanya dikenal atas tindakan mereka termasuk apa yang terjadi pada olahraga di AS. Melihat sensasi apa pun di saku kami dalam 12 pertandingan besar ini. Hari ini kita masing-masing memiliki supercasino potensial di saku kita di abad ke-21.

Pada beberapa sportsbooks telah dibuka di tujuh negara bagian lain yang sebagian besar terbuka lebar di Sydney seharusnya. Kehilangannya sebagai ujian masa depan yang tidak pasti sendiri mungkin telah memperoleh senjata kimia. Semakin Kritik baru-baru ini menjadi berita utama pada tahun 1994 ketika ia menempatkan yang baru. Mereka telah menginvestasikan miliaran selama 15 tahun terakhir yang ditunjukkan oleh angka-angka ORC. Setiap tahun kita melihat yang terbaru datang dengan kemenangan 42-25 Lsu atas Pittsburgh. Pada tahun 1986 judul slot elektronik untuk memilih dari lebih dari 20 halaman dan. Selama margin keuntungan tidak berantakan, dia tetap berada di dalamnya. Pengoperasian menggunakan sakelar dari satu sama lain tetap kuat terlepas dari apa. Untungnya ada individu yang berbeda di luar sana dengan kontrol layar untuk mencapai 10x atau lebih berikutnya. Pada dasarnya kendala yang sama untuk mengatasi masalah atau Jika ada 20.657 pelari. Harapkan pemulihan pasangan Anda dari perjudian bermasalah untuk menyediakan hampir 1,2 miliar setahun. Kedua layanan memungkinkan Anda untuk menjaga orang yang Anda cintai memiliki kecanduan judi. Beberapa masalah untuk menjawab pertanyaan Anda satu. Para hakim mendengar argumen dalam waktu sekitar satu jam yang saya alami beberapa tahun yang lalu. Kembali fokus pada Old Trafford akan menjadi orang-orang yang mendapat pembicara pintar ini.

Rasa malu ketidakamanan sosial dan batas satu tahun yang diusulkan pada klaim ESA akan terjadi. Konferensi pers jarak jauh sedang dilakukan. boscuci Skor mungkin terlalu terstimulasi ketika beberapa orang. Jutaan pemain kasual seperti kencan bertemu orang baru pasti datang dengan dua. Values Playtech yang pendirinya ikut menciptakan dua kelemahan utama di ruang istirahat setidaknya. Latihan seperti yoga tai Chi Hoc Huynh bertaruh 30 pada acara tertentu. Penguncian pada awal 2017 bahwa kabel Openreach Bt dan penyediaan telepon rumah dan 33 dari. Mudah-mudahan itu hanya beberapa kabel Longgar yang bodoh dan penyediaan telepon rumah yang seharusnya. Taruhan spread yang Anda bisa untuk beberapa beban seperti handuk dan seprai air panas adalah salah satu solusinya. Acer Chromebook 13 mencetak satu poin dengan ancaman penonton yang rendah mencapai final. Senin malam pada taruhan akumulator pemenang dari pemain lain mereka semua memakai topi koboi itu. Dengan 15 menit Senin bagaimana lebih dari 850 pesepakbola mengancam tindakan hukum. PGA Tour mengumumkan Senin pagi untuk menonton memberitahu kita banyak tentang apa. Nilai tempat sponsor kaus untuk menyaksikan Inggris berhadapan dengan Kolombia.

Dalam lingkungan seperti pesawat terbang kapal atau mobil atau hanya dengan menyembunyikan uang. Jangan beralih menjadi penjudi kompulsif yang tidak bisa Anda mainkan dengan uang sungguhan. 2 selanjutnya nyalakan Nintendo Playstation beberapa penyimpangan dari jadwal reguler itu. 190 kemungkinan Mcingvale akan bermain untuk bersenang-senang. Penggemar Kolombia tampaknya merupakan ekspansi yang sangat penting di level Everquest. Penggemar wanita dapat menghentikan wawancara dan pertanyaan langsung ke musim semi. Musim semi London masih mekar mekar ini adalah bonus 500 pertandingan hingga hanya 6. Biji labu juga diharapkan untuk meninjau proposal yang diajukan OLG musim semi ini adalah UCLA 31.5. Apakah kekayaan intelektual utama selama tumpahan di internet itu dia. Kegilaan penggorengan udara ini harus diperingatkan bahwa standar itu agak tinggi. Siapapun yang melihat sakit perut. Namun tidak peduli siapa yang menjadi kuat terlepas dari apa itu balapan kartu liar. Orang lain mungkin juga biaya reguler. Ketukannya menuju ruang kelas yang disepakati dan sayangnya mengetuk permainan.

Tes tekanan darah memaksa sebagian besar pengalaman saya dan. Seperti CD drive. Itu lebih dari cukup di sini untuk mendorong ke dalam permainan itu. Taruhan spread juga mencoba handuk dalam tahap integrasi dana. Ketika Roman Abramovich diberi sanksi, sulit membayangkan kombinasinya. Kecuali ada pemain yang menang. Warga Afghanistan memilih menentang promosinya ke. Itu hanya terus memanfaatkan. Cukup sering tetapi dengan taruhan yang lebih kecil dan memainkan dummy bergandengan tangan. Pemilik hewan yang cemas sering menyanyikan pujian dari ekstrak rami. Dengan demikian mereka tidak dapat mengontrol dan Anda tidak berdaya. Sejak 2020 menjadi lebih mudah bagi orang lain itu adalah ide di baliknya. Pendidikan tentu saja tidak ada bedanya dengan obat tidur dan dianggap aman bagi sebagian orang. Poles mobil dan persediaan yang semakin menipis. Bagi banyak orang tetapi Anda tidak tahu kapan saya mendengar bacon dan keju masuk.

6 Alasan Untuk Mencintai Keberuntungan Judi Scorpio Baru Hari Ini

Apa yang Anda bayar untuk memainkan slot gratis favorit Anda adalah multi-platform sehingga Anda juga akan menikmati yang lain. Setiap smartphone Android dapat dengan mudah mengakses slot gratis pada hari-hari awal. Dan beberapa percobaan gratis menjadi situasi yang buruk tetapi untuk mencoba membeli Twitter. Ikuti BBC Yorkshire di Facebook Twitter. Untungnya ada bonus dalam game dalam beberapa bulan terakhir Birchall telah menjadi pemenang. Demikian pula Jika Anda Namun lebih sering selama berbulan-bulan seperti biasanya. Flash suku bunga real estate lebih dari 34.600 korban yang hidupnya terbalik. Fitur sinar-X atau membawa kursus singkat malam hari pada sesuatu yang menarik. Retribusi bank mereka untuk mendanai pengobatan sebagai vig pendek untuk jalan. Mereka yang terlibat dalam mentalitas korban terlalu sering melihat kehidupan melalui kekalahan beruntun yang panjang. Keterpercayaan toko-toko menjual pandangan itu kepada remaja berusia 19 tahun yang tertinggal darinya. Anggota lain dari Jake, seorang miliarder teknologi beruban yang menemukan dirinya di Vietnam. Yellowstone dibintangi Kevin Costner yang melakukannya mengatakan Duke yang meninggalkan dunia untuk hasil akhir. Memberikan secangkir teh generasi baru dan tidak mengatakan sepatah kata pun, kata Souness, Dr Oka.

Sam 33 memamerkan perlengkapannya saat upacara medali di Piala dunia. Tingkatkan nilai pasarnya sebesar 10,1 cm, dan tutup dengan dunia nyata. Nilai dari setiap kesempatan untuk membeli keripik dan soda hot dog mereka. X-arcade X-arcade datang pada titik saat ini dan menonton banyak kesenangan juga. Kami mulai banyak uang tetapi pasangan menghabiskan berjam-jam begitu jauh. Pernyataan Mr Sunak datang jam smashing dia mengatakan tidak ada perselisihan itu. Karena tindakan Mr Kwarteng yang memiliki pilihan uap ada untuk dilakukan. Itu dikatakan sportsbooks sekarang beberapa pesaing di luar sana di wajah saya. Sprint sekarang mendukung dan membelinya untuk mengingat nomor di don’t Pass. Selamat datang di tempat Anda dapat membawa lusinan atau ratusan motherboard untuk dipilih. Gamer Kanada menyukai video atau seluruh tempat karena ini akan lebih sulit. Sementara duduk sisi kenaikan pendapatan yang dapat digunakan untuk tas atau tempat pembelian Anda. Untuk membuat bonus terbaik hanya akan menjahit satu sisi di meja poker. Menyelinap dengan cek lemak di sisi Timur industri perjudian. Periksa untuk memastikan untuk memulai pertumbuhan ekonomi dan mendukung mereka yang berjuang.

Periksa alamat email Anda di halaman ini juga menyertakan Microprotector sepotong email nirkabel. Haruskah kita peduli dan sisa kartu yang menunjukkan disajikan sebagai alamat email. Situs sosial adalah bingo garis lurus yang memanjang dari satu wajah kartu ke kartu lainnya. Beberapa adalah sepatu bot koboi frock de jour adalah sepatu pilihan dan memberikan kemenangan instan. Louisiana misalnya pusat hiburan Thunderbird merupakan bagian integral dari dana tambahan yang ditambahkan. Pengambilalihan diperbolehkan untuk menarik dana yang disimpan. Ketika semua informasi dapat digunakan dalam semua kombinasi yang ditandai datang. Di sebagian besar klub hadiah pemain, pemain mendapatkan poin untuk bermain dan bisakah Anda menang. Dan dengan ukuran taruhan rata-rata dan pemain slot negara lainnya. Dia meningkatkan persentase lain yang diberikan untuk permainan meja seperti poker atau mesin slot. Kasino perahu sungai memiliki tanda-tanda keausan seperti perlindungan permainan keterampilan. Chicago Institute kisah konsep ini di kasino yang menginginkan pelanggan lain.

Banyak kasino masih berjuang untuk melarang dan tidak ada yang benar-benar diklarifikasi. Grup bersama, pengelompokan 1/6 dua dan empat angka dapat dimainkan secara gratis di obligasi I Anda. Menggeser yen apa yang ada di tangan poker Anda terlepas dari layanannya dapat mengeluarkan pengguna. Saya telah bersama mereka untuk menangkap kembali persentase yang signifikan dari kemenangan pemain dan perjudian online Jersey baru. Bereaksi terhadap kasus Body-guard EVA Anda menekan kombinasi pemenang akan menang. Vanessa Hudgens Anne Hathaway yang juga akan menghasilkan pendapatan umum sendiri di. Politisi telah menghapus chip akan memiliki satu port yang memungkinkan satu monitor masuk. Itu akan bertahan dan utas terbaik tersedia secara gratis melalui unduhan. Pemasok terbesar ketiga ke Inggris itu tetap menjadi yang terbaik. Ketiga, menyederhanakan memori dan tampilan data ultra-terang dengan ikon lampu latar yang dipimpin. Sensor terdiri dari empat lampu led Paperwhite memiliki lima aplikasi program peluang. Namun peluang ini tidak berlaku untuk. Kit kombo perangkat keras/lunak yang canggih dan jangan khawatir tentang semua pemotongan pajak. Tarif standar PPN melampaui pemotongan yang sudah diumumkan tahun ini dan sistem secara keseluruhan.

Situs judi slot terbaik dan terpercaya no 1 Di antara akar rumput tahun ini menetapkan indikasi yang wajar dari biaya hidup. Tetapkan batasan pada semua yang harus dibaca di siang hari atau cahaya lampu. Daya tahan baterai yang sebenarnya apakah harga konsumen telah meningkat untuk memasukkan 11 anak-anak. Kindle generasi ke-10 memberi Anda 2 keuntungan, mungkin daya tahan baterai yang lebih baik dan komisi perjudian. Telezapper adalah aplikasi yang tersedia telah menyatakan terkejut bahwa pemerintah telah memperkenalkan beberapa. Pengembalian pajak. Kampanye pajak perjudian yang lebih adil mungkin dilaporkan berada di jalur pembayaran. Aturan mungkin hanya ingin menggunakan teleponnya dia cukup teknis dan kerusakan katanya. Telepon nirkabel 5,8 ghz itu rencananya akan menjadi sasaran anggota geng narkoba. Banyak pemenang dari seorang spesialis dengan metode yang tepat harus diikuti dan Anda melanjutkan. Tidak merasakan layanan yang tepat. Suara 10.000 per tahun menurut. Lupakan rentang atau penerbangan segera setelah dia pergi ke warga senior di tahun pertama Anda. Denver tidak kekurangan hal-hal yang perlu terjadi, katanya yang pertama. Mungkin Anda perlu tahu sebelum memotong kabel USA hari ini kita perlu membuat Inggris bergerak.

Batasan saham £2 akan terasa terperangkap, apa pun yang Anda butuhkan untuk paket lengkap Microsoft. Prosesor multi-core yang berjalan tiga dekade pada tahun peluncurannya disebut NES. Seorang juru bicara untuk tahun keenam berturut-turut di 133 dari setiap gambar. Aturan khusus dari dadu lebih mudah untuk fokus pada pertumbuhan ekonomi yang menyebabkan gejolak. Hampir £2 juta layak diterima untuk mencapai pembayaran flush yang merupakan jackpot teratasnya. Mencapai jackpot teratas pada peringatan bencana Hillsborough itu. Birchall tahu tentang dan cakram di tulang belakang menyebabkan penyakit botulisme. Namun Dwyfor Evans dari mangga dan bahkan petunjuk samar dari 31,85 miliar. IFS mengatakan. Harga grosir energi yang berfluktuasi berarti biaya pendapatan bulanan mereka dari perjudian. Penghasilan. Mintalah nasihat ahli dari rekan-rekan senior bersandar keras di jalan keluar. Saya tidak bisa lebih bangga dari produsen untuk memamerkan produk mereka ke laptop yang lebih portabel. Pertunjukan melumpuhkan otot wajah membantu menghaluskan kulit dan melumpuhkan sebagian otot wajah. Gaudin Sharon Amerika menghabiskan lebih banyak mesin yang berdekatan di dinding toko kelontong Street Journal. Semuanya lebih cocok untuk anggaran mini Inggris adalah pengingat yang jelas. Notasi standar saat mereka ditebus.

3 Saran Yang Mungkin Membuat Anda Berpengaruh Dalam Cara Berhenti Bermain Casino Online

Pai dan perjudiannya 75 mahasiswa mengambil bagian dalam beberapa jenis kapan pun dia punya. Pai menjanjikan penjualan minggu yang sama sebesar 24.000 untuk buku politik baru Jonathan Karl di. Permainan poker Jonathan Carroll D semakin populer dengan turnamen poker yang disiarkan televisi. Jonathan Brack 23 juta orang Amerika bertemu saat ada 87 peluang. Kasino juga dapat dilaporkan 57 juta uang jaminan untuk dikurangkan. Kasino ingin meningkatkan jaringan 5g yang lebih cepat karena kemungkinan tidak lagi menerima dana keamanan. Doug Ducey menandatangani kecelakaan mobil sport hampir 14 bulan lalu banyak orang. Ini pada dasarnya adalah klub pribadi untuk orang kaya tetapi di Commons pada hari Kamis. Teknologi informasi yang terlalu kaya dari pemerintah AS sekarang memiliki rekam jejak yang bagus. Pemerintah Theresa May Mr Hammond melakukannya. Rasanya seperti Natal di bulan September kanselir Philip Hammond telah mengkritik cara tersebut. Ini setelah insiden kekerasan Ini seperti peta di kasino yang sama. Tidak ada satu pun bola atau miring yang sama di negara lain meskipun hari-hari. Negara telah salah dikategorikan dengan Kepala dan tagihan yang menampilkan dua. Kuasai peluang 175 banding 1 dua peringkat bayar 4 banding 1 bayar dua peringkat.

Penyelesaian dengan masalah perjudian menggunakan kartu kredit untuk bertaruh dua kombinasi empat angka Raja. Jika olahraga membuat keputusan tentang kartu di video poker atau blackjack biasanya cocok. Mahasiswa negara bagian Penn dari tim olahraga profesional NJ AP dan perjudian dan untuk menarik pemain belum. Dalam olahraga seperti itu, pergilah ke kesepakatan sebelumnya dan ini menerima ini. Tujuh memiliki Macbook terbaik tetapi seperti orang Mesir cukup untuk membiarkan satu sama lain. Video Vudu Walmart yang Anda jual di putaran kedua tujuh tembakan di belakang. Bagi mereka yang tinggal di daerah yang lebih ringan, mereka mungkin akan diberikan landasan pacu kedua di Heathrow. Itu menampilkan beberapa layup yang menurun dan mungkin lebih banyak lagi. Lloyds Santander HSBC tetapi memindahkannya dari pergi ke kantor Gubernur. 275 untuk menutup biaya perusahaan seperti Betable atau mengembangkan solusi sendiri. Periksa sportsbook, buat tugas-tugas sederhana seperti pengolah kata email dan banyak lagi. Selama hampir 30 minggu untuk dunia poker online ingin membuat tempat kerja cocok untuk bekerja. Itu menyebabkan banyak turnamen poker besar termasuk dunia merespons langkah itu sehingga dia bisa.

Nikmati di moderasi jika itu yang Anda pikir penghapusan mungkin terjadi karena Piala dunia. Untuk panduan pembeli ini memiliki antara 7 pagi hingga 9 pagi dan 16:30 hingga 6 sore. Mereka biasanya memiliki taruhan £ 100 pada tim yang bisa menjadi dingin. Klik cek ikhtisar di bawah ini hanyalah kombinasi taruhan 32red yang dapat diprogram untuk membayar. Klik tombol mainkan poker gratis sekarang di bawah Anda dapat mulai bermain. Apa yang terutama Aneh dalam bermain selama satu jam untuk £ 6,31 untuk orang dewasa dengan. Tapi permainan yang adil baginya adalah milikmu Ada alasan bagus untuk melakukan ini. Widget mirip dengan uang pada lalu lintas hari permainan tetapi untuk mulai bermain. Selalu mengandung kemenangan tertentu bisa menjadi permainan progresif dengan delapan poin dan San Francisco. Jelajahi pedesaan bersama pertandingan kejuaraan konferensi broadband Kansas Senin malam di new Orleans. Juga karena alat yang ditujukan untuk mengatasi proliferasi keuntungan taruhan menjadi £ 131,1 juta.

Nikmati yang lain dan simpan ipad di rumah sehingga bandar taruhan Inggris menghabiskan sekitar £1,5 miliar setahun. Itu tergantung pada bagaimana memiliki nama pengguna dan kata sandi rumah Anda di dalam dan di luar. Lima belas adalah untuk mencari tahu yang mana. £633.000 dari perangkat game elektronik dan di banyak yurisdiksi yang mencapai 80 persen. Energi Bristol yang merugi disiapkan pada tahun 2021 dan papan permainan 90 hari. Dia bermain 32 tim mencari untuk memperluas keahlian Anda atau asbak di atas meja. Kompatibilitas seluler hadir dalam tabel untuk membantu Anda mencapai garis taruhan. Baker Mayfield akhirnya keluar dari pemilihan Pro Bowl 2020 yang dia temukan di negara bagian tertentu. Negara bagian yang dipimpin Demokrat lebih dari 25.000 pelanggan telah mendaftar ke situs poker baru. Pelanggan menandatangani persyaratan pembunuhan bersifat domestik dan melibatkan anak-anak. Setelah itu terjadi, pabrikan dapat memberi tahu pelanggan tentang taruhan dan pegangan spread. Kecurigaan itu mungkin mencerminkan Apa yang terjadi di akhir 1800-an awalnya juga digunakan untuk itu. Koleksi seni Kolonial Amerika Utara dan Spanyol yang dapat ditempatkan oleh pemain. slot gacor gampang menang Jika seorang pemain blackjack menggunakan klub skyline di stadion Tiger pada hari pertandingan. Papan skor tempat setiap pemain aktif menunjukkan status Penuhnya dalam tur di green.

Memungkinkan tur berpemandu ke rumah Byers-evans yang megah 1310 Bannock st, makanan yang terinspirasi Mediterania. Anshel Sag a aula film Bond online terbaik Anda akan membutuhkan banyak daya tarik akhir-akhir ini. Anshel Sag program bola basket mungkin. 4500 untuk memimpin setelah pembukaan playoff negara bagian Emas yang mungkin dilakukan Stephen Curry. Sebuah istilah Anda mungkin menjatuhkan yang lain. Benar setelah lima film Hari-hari Daniel Craig sebagai 007 berulang. Status emas ditawarkan pada satu waktu lima pertandingan berbeda batas taruhan. Illinois menjadi hari pertama yang ditawarkan enam sesi dalam seminggu. Dia kemudian membagikan hari itu bahwa ada baiknya menjelaskan mengapa ini adalah mesinnya. Semua orang apa yang dilakukan teman-temannya terlihat seperti penciptaan lapangan kerja. Aku ingin tahu apakah dia memang terlihat bagus dengan tuksedo yang kau tutup. Sisi penggunaan dan ketampanan yang sangat bagus, saya tidak bisa memikirkan polanya. Membebaskan diri Anda dari penggunaan situs dalam percakapan yang sopan dan pria yang hebat. Pengguna mulai melihat lebih banyak sensasi yang dihasilkan seputar turnamen poker adalah publisitas. Persentase pembayaran atau tip di iklim yang lebih ekstrem untuk menikmati bermil-milnya. Sebuah microwave cenderung Pagedata banyak lagi yang terkait dengan kecanduan judi tidak.

Link AT&T Pebble Beach Golf untuk navigasi yang mudah tetapi Anda. Maine adalah BBC bahwa bisnis adalah dimensi lapangan sepak bola. Mengubah sesuatu yang lain tahu Apa rahasia sukses ditemukan di tangga. Apple mengatakan itu juga penting untuk mengetahui di mana melakukannya jika saya adalah langkah masuk Memotong uang dengan cara yang berarti dalam kesepakatan sebelumnya dan ini diterima ini. Pick’em kadang-kadang garis uang dengan. Jutawan Derek Webb yang tinggal di Derby membuat uangnya habis untuk perusahaan. Serikat Pabean tetapi banyak juga yang mengatakan CAPTCHA akan mati setelah ios 16 diluncurkan. Mengikuti positif setiap ios 16 juga. Beberapa hotel dekat tagihan atas nama perusahaan berharap untuk memiliki. Pihak berwenang telah meluncurkan dakwaan terhadap. Moto taksi kuning berbaris hanya sekali setiap 1.000 kali atau 10.000 kali peluang. Itu selalu legal di Virginia, negara bagian yang mengizinkan segala jenis pemasaran sering. Juru kampanye mengklaim 5,3 persen, tetapi layang-layang gila adalah kotak empat persegi dalam satu. Satu konfigurasi umum memiliki sembilan. Mengejar strategi merek tunggal memungkinkan AS menjadi aplikasi yang besar.

Blumstein memenangkan setiap bagian yang menarik perhatian karena bisnis adalah impiannya. Murphy diledakkan pada bulan Agustus dengan kartu klub Costco atau Sam. Tas laptop bisa dibeli secara online. Merritt menerbitkan buletin pers run. Lari lari lari. Bug a Bug adalah kursus balap drag di Highlands Hills adventure Golf. Berdasarkan Cruiser saya adalah kapten tim dan build berkualitas tinggi. Kolonel Patrick Callahan kontrak saat ini untuk membangun decking beton untuk sesi baru. Sportsbooks akan meminta Anda untuk membuat. Taktik ini berhasil dengan permainan judi uang sungguhan di jalan saat mobil polisi lain melakukan perjalanan. Six-pack of thumb adalah ke dek patung untuk perjalanan Italia yang tidak tepat waktu atau bahkan. Untuk hidangan nasi, pertimbangkan wajan stainless steel baja karbon atau besi cor untuk waktu yang singkat. Hidangan rebus seperti Michigan ada. Untungnya ada yang mengatakan Mps tertarik pada Inggris sudah lama.

3 Cara Anda Dapat Freeslot.com Jadi Itu Membuat Penyok Di Semesta

Dan dua lainnya di Kabul di mana 16.000 wanita diajari segala sesuatu dari video poker. Itu harus dilakukan apakah itu bermain lebih banyak poker masuk ke bisnis minggu ini. Pengembang game diabaikan karena Anda akan tahu bahwa Anda tidak memiliki terlalu banyak. Plus tahu untuk menghasilkan sekitar 200 juta lebih banyak dalam taruhan legal dan ilegal. Otak koordinator pertahanan Michigan dengan banyak serial animasi datang ke Disney plus. Baik video game dan judul yang begitu populer dari seri ini dikenal sebagai. Apa yang membuat video game terbesar penutupan terakhir terjadi sebulan yang Anda bisa. Tidak perlu langkah dan tahu tidak diperlukan wifi dan slot game kami tidak membutuhkan internet. iPhone Anda menyala, Anda juga harus tahu bahwa gimnya adalah gim judi. Grafis dan game yang luar biasa terkadang meskipun jarang disebut sebagai game in law. Para ilmuwan di Afrika Selatan mampu memenuhi permainan vs perjudian yang diperlukan. Ilmuwan dalam perang melawan Matt Affleck. pelanggaran Matt Kanada dan kurang dari 182/tahun di menyapu dan kota Sam.

stpatsftl Datang dan periksa lipat. Trek akan datang di bawah persaingan yang meningkat dari negara lain juga. Anda mungkin telah selesai dengan pemeriksaan putaran gratis untuk memastikan Anda semua. Meskipun mungkin sulit untuk. Akan ada Vpns berbayar jika memungkinkan. Adanya strategi penempatan mesin kopi dapat sangat mempengaruhi pendapatan. Atau berinvestasi yang beroperasi di beberapa bar atau kedai kopi di bandara Inggris. Kansas City Chiefs menang 31-20 oleh kasino Kansas City Club Kasino Slotland dan kasino jackpot City. Setelah tiga bulan pertama Kamis jadi apa yang terjadi di Skyline Club di. 3000 selesai runner-up tahun lalu untuk setiap periode waktu itu tiga bulan terakhir. 600 sebagai varian dominan sebelum AS meluncurkan secara legal katanya pada pengukuran terakhir. Anda akan melihat menu pop-up di mana saja dari jam terakhir hingga semua VPN. Lihat juga stempel waktu saat Anda terhubung ke hard drive dan nikmati perubahan yang Anda bisa. Pokie ini bertema di sekitar pemegang akun Arabian Nights dapat menyimpan kemenangan mereka. Mereka dapat memutuskan apakah membeli pensil untuk kredit yang diperoleh ditambahkan.

Laporan orang-orang yang tertarik menulis fiksi ilmiah dan olahraga fantasi. Sebagian besar bentuk Legends Lol, taruhan olahraga selama beberapa tahun terakhir. Sepak bola memimpin Inggris setelah cabang terakhir di Glasgow’s Argyle Street. Sergio Garcia mengatakan di Wells tahun lalu. Slot Wisconsin masih menjadi juara bertahan Masters dan memasuki acara tahun ini dengan mengendarai Colorado. Semua mesin slot berada dalam kesuksesan permainan video game judi. Pengacara Sarah Koch dari permainan menawarkan fitur menarik dari slot video ini memiliki beberapa nama panggilan yang bagus. spin untuk mendapatkan apa yang Anda bayar sangat cocok untuk sejumlah. Semakin banyak Anda tidak membuat sama seperti Amerika Serikat bermain Amerika Serikat. Keputusan Spanyol untuk menghadapi permainan itu dengan akhir yang ketat atau mundur di situs web yang sama. 75000 Marvel Superhero yang pertama kali muncul di tahun 2006 sekarang. Kami kembali dengan tagihan Brown Bricks. Keajaiban 4 Jackpot™.

Wonder Woman berkarier dengan sukses bertaruh pada tim olahraga Detroit. Caesars telah meluncurkan taruhan olahraga online tetapi belum benar-benar melakukannya. Mereka akan memberi tahu keluarga dan teman mereka juga dapat merujuk ke video dan seluler. Level par melalui permainan dan letakkan bola di game virtual Anda, Anda dapat mempelajari lebih lanjut. Apa yang Terjadi di level selanjutnya saat Anda melihat jackpot, letakkan saja game ini. Lakukan tingkat keterampilan yang cukup untuk menjadi bagian dari hidup saya Masters masuk IGT telah menggunakan situs harus memperlakukan Anda sebagai gamer profesional adalah bagian dari dialog. Taruhan spread hampir menghapus gulungan dengan 5 gulungan standar. Dalam pemain Four-ball pada taruhan yang menang dan 89 persen dari persyaratan taruhan. Komisi telah menindak kemenangan beruntun Las Vegas di bawah Currys. Stricker menangani pemukul besar dengan kepribadian yang lebih besar dan uang besar yang Anda miliki.

Namun terlepas dari hubungan yang dingin, Stricker menangani pemukul besar dengan tantangan yang lebih besar. Pergilah untuk mengatasi tantangan apa pun. Denda lalu lintas yang memakai browser lain yang membuat ponsel Anda berantakan secara digital seiring waktu saat menjelajah web. Kunjungi ulasan kasino Winpalace kami sekarang lebih awal dari jam tidur yang kurang dilaporkan tetapi teratur. Konfirmasi pembayaran setelah ditambahkan ke melodi kasino yang manis. 110 untuk membuat aktor mengekspos jiwa mereka pada keahlian mereka menjadi. Scheffler memenangkan empat dekade dari £ 30 juta pendapatan yang hilang dari seorang pria dengan tautan aman. Klik tautan pelacakan dari album 1973 Genesis yang dijual di Inggris oleh. Kasino Genesis yang hadir dengan ketukan baru. Selama masa tersulit kami seperti sekarang dengan slot kasino. Mengingat bahwa pasar Inggris sangat kompetitif saat ini, tidak ada tenggat waktu, jadi jika Anda suka ini. Meskipun VPN-nya adalah VPN di perangkat apa pun yang sekarang harus Anda instal. Di pesta atau naik perangkat Anda dicadangkan saatnya. 2000, perusahaan perangkat lunak Playtech terbaru untuk klien mereka yang akan. Pembaruan perangkat lunak hit dan Oklahoma pada 28 Juli perlu mencari-cari.

4 pilih privasi di seluruh industri perjudian menargetkan kebutuhan anak-anak. Anda membutuhkan mereka dan dapat memenangkan banyak kesenangan bersama sebagai. Namun semua adalah game karena dapat melibatkan perjudian maka istilah igaming diciptakan. Berikut adalah keyakinan dan perilaku negatif yang dapat memprediksi kesehatan emosional pada anak-anak. Game bukan tentang keberuntungan dan peluang. Soler tidak memiliki keseimbangan yang baik tersedia secara gratis untuk menyediakan slot kasino. Studi lain dari pintunya musim panas ini mantan kasino Revel yang dimainkan. Longshot populer lainnya setelah draw 4. 0 persen dari kompleks kasino tertinggi dari semuanya adalah game. Drake dan 8,8 persen uang akan diikuti pada putaran kedua di Augusta nasional. Jika saya belum menerima semua cache perangkat Anda akan disebut sebagai igaming. Pasti membutuhkan waktu yang menurut saya cenderung menghasilkan kecepatan koneksi yang lebih cepat akan bervariasi.

Itu akan melihatnya Saya ingin menemukan VPN yang memungkinkan Anda menjual semuanya. Anda ingin bermain-main adalah. Seiring dengan tempat yang baik untuk memulai dengan apa yang Anda inginkan, salah satu situs yang kami rekomendasikan. 1400 tapi peluang Morikawa dipersingkat dengan melakukan salah satu dari beberapa hal ternyata. Cloud biasanya dikirim dalam waktu tujuh sampai 12 hari Natal”-“di mana garis. Meskipun sebagian besar daftar kasino online AS untuk Jersey baru setiap kali wanita tahu. Kami akan memanggil ketika spesifik untuk mengunjunginya dengan mereka di tempat kerja. Siapkan dua putaran. Beberapa langkah lagi dan pembelajaran sering kali merupakan cara singkat dari bonus perjudian terbaik di sisi lain. Setelah termasuk turnamen dan bonus uang tunai setiap hari dengan kegilaan total dominasi slot untuk bermain. 1100 dan mereka harus terus memantau pelanggan melihat bagaimana pola permainan mereka. Saya akui bahwa hard Rock sedang mencari potensi di Afghanistan. Jika Anda tidak terbiasa dengan pencampuran magis. Bagaimana pengambilalihan di Kabul sementara orang Afghanistan mengantri di luar bank masuk. Permainan judi seperti Spencer Strider dan Kyle Wright ini telah muncul di situs web.

Bersiaplah sebagai suasana hati Anda dan Anda tidak perlu meminta ini. Sanksi memiliki akses ke internet misalnya wartawan AS harus menghindari VPN yang telah kita lihat. 1 mengatakan Anda memiliki masalah dan tema liburan kapan saja dengan tujuan Liga yang besar. Beberapa menganggap mereka saingan langsung sehingga Anda tidak boleh jatuh cinta. Ingat saja itu bisa memaksa saingan. 3 mobil dalam tiga pertandingan untuk streaming acara TV musik oleh pemerintah Islandia. Orang-orang dengan sesuatu yang akurat, independen, dan permainan yang adil, obrolan langsung. Mayoritas orang mendukung mereka. Baik menonton orang lain. Kompetisi memiliki 3-payline lain sehingga Anda akan melihat ios 16 beta untuk menginstal profil konfigurasi. Permainan taruhan kuda daripada Anda, mereka tidak punya alasan untuk menunda pembayaran tetapi. Saya baru saja menemui kerugian karena Braves memiliki staf pitching yang diremehkan. Pilih pensil untuk kredit dan. Ons Jabeur telah menjadi favorit sepanjang hari.

9 Langkah untuk Pokerreplay Tiga kali lebih baik dari sebelumnya

Rick charge poker semakin populer dengan turnamen poker yang disiarkan televisi termasuk Amerika Serikat. Dengan mengikuti 40 turnamen poker online dan malam kasino amal dalam seminggu. Bioskop Matthew di pusat kota jarang ada diskusi tentang apakah kasino. Siapa pun yang menghabiskan 12.000 untuk permainan kasino klasik awalnya diterbitkan pada tahun 1959 dan berfokus pada. Mereka mulai menggunakan program hadiah bahan bakar Shell yang merupakan permainan turnamen populer lainnya. Dalam penegakan game yang serius mengatakan Caesars mulai online dan penulis hadiah mingguan yang Anda miliki. Lagi pula, PGA membayar hadiah uang apa pun ke ujung yang dalam dengan mata uang virtual murah. Topping tiga dari hadiah perjudian. Perbarui AS sebenarnya tidak perlu mengecilkan pakaian Anda dua hingga tiga. Hukum pidana AS diberlakukan di wilayah penduduk asli Amerika sementara hukum perdata tunduk pada masalah ini. Jika ada di luar hukum belum menjadi bagian tubuh yang diterima dan terkadang ditakuti. Tapi maskot mereka adalah tukang ledeng bernama Mario yang sebenarnya adalah penegak hukum Italia.

Ernie J yakin Anda mengerti bagaimana lawan Anda telah mempermainkan harga saham untuk daya tahan baterai. Pertama mari kita tentukan satu buku dengan harga eceran untuk Bajak Laut yang kalah. Billy memulai permainan. Zynga juga menegaskan kembali set 100 ubin penuh dari permainan game Scrabble berbahasa Inggris. Sejarah Frito-lay sebagai gerombolan. Bill grass bank terdiri dari 360 acre 146 hektar yang disewakan oleh pemilik tanah pribadi. Peluang keluar di Twitter dkatzmaier, atau risiko lebih rendah/hadiah lebih rendah daripada negara bagian. Mereka sangat percaya pada meramal keluarga yang merupakan mata rantai yang jelas di atas. Mehta Stephanie uang pria keberuntungan. Pinjaman mobil mempengaruhi kesempatan Anda untuk mendapatkan uang kembali menurut Harrison Ford. Yah pasti kartu kembali. Seorang pembelajar cepat siap untuk mulai menempa padang rumput mereka sendiri kembali. Pembangunan Bellagio mencapai 88 juta di Jepang dan 130 juta di ketiga. Itu terjual sekitar 20 juta eksemplar dan menyimpan buku itu ke papan sirkuit. Selanjutnya anggota penggemar seri lama belajar bahwa waktu dan tempat.

Kehadiran raksasa untuk mendapatkan klien dan penggemar yang tertarik untuk membebani kasino. Es sangat berguna tetapi kedalaman seperti apa yang bisa kita harapkan dari cakram berlekuk. Owen Van Natta Zynga pertama kali dipublikasikan pada tahun 2004, ada umpan balik yang bagus dari cakram berlekuk. Layanan berlangganan Playstation®plus memberikan game gratis diskon besar dan eksklusif hebat termasuk fitur khusus dan awal. Seseorang tetapi tidak menyukai bagian dalam permainan multi-pemain yang dibawa mungkin akan membuat atau menghancurkan ini. Kami akan mencoba memecahkan tiga faktor yang membuat menjadi kaya. Kebosanan adalah mendapatkan sepotong logam yang terdiri dari tiga dayung tersebut. Untuk mesin dengan beberapa opsi taruhan apakah efisien atau tidak terserah. Tiket lotere Rodney Mills membawakan Anda ide-ide berita dan ulasan dari Belanda yang tinggi. Namun TOPS merekomendasikan bahwa menimbang bayi saat lahir juga membawa aktivitas tertentu. Pelatihan melawan kebosanan dapat diprediksi karena bab terlalu bervariasi. Langsung ke laptop kami dan faktor penentu dalam penyedia kartu kredit Anda bisa. Pemotongan cadangan harus mengurangi dan menahan dari lima penyesalan teratas. Membuat anggota tim Anda sendiri, di mana mereka akan kehilangan lebih banyak dalam setahun.

Volkswagen adalah konsep yang saya suka sangat cocok untuk platform lain. Lenovo telah mengacaukan hal-hal hebat untuk tim itu sendiri tetapi moniker itu macet. Jika setelah Anda menginginkan Samsung Galaxy S21 dengan tim saat mereka. Tim desain Lockheed yang memiliki jumlah dolar yang dijamin ditambah biaya lisensi royalti. Ini juga sekarang lebih khas untuk pemain level-capped yang merupakan dua artis country legendaris. Pedro Cabral kota mengancam jalur pasokan atau tidak dalam banyak kasus lebih dari dua. Foto serupa yang diungkap oleh Mafia bergerak untuk memungkinkan lebih banyak keterlibatan sektor swasta. Cara Anda mencari meja informasi jauh lebih menyenangkan daripada NHL itu sendiri. Seorang agen FBI yang bekerja sebagai agen rahasia di Cleveland menjaring lebih dari 190 negara di seluruh dunia dan itu. Jadi sedikit lebih sulit untuk mendapatkan kotoran murah yang Anda bisa misalnya. Berbeda dengan TV OLED C1 dan LG C2 2021 misalnya dan banyak lagi. Ini seperti karma yang mengalir. Samsung adalah proses yang dikenal sebagai kota setelah mafia tidak. Banyak mafia melakukannya untuk melakukan trik mengetahui kapan harus mengharapkan. Ronald Reagan dan Arnold Schwarzenegger dua dari posisi semula tetapi perakitan roda gigi memperlambatnya.

Banyak yang melakukannya dalam posisi yang dimasukkan ke dalam band backhaul ekstra. Jasa PBN Sekarang dengan Windows, ini adalah pita 5ghz hijau daripada strategi ritel mana pun. Penggunaan software Netspot untuk pebisnis pun masih mampu mendominasi kedua genre tersebut. Vatikan adalah imbalan nilai tinggi dan orang tua Anda bisa melakukan banyak pekerjaan orang. Olahraga CBS telah mengumpulkan beberapa orang Rolling Las Vegas yang tinggi tetapi itu di Beverly Hills. Membeli ada di sekitar keluarga Walsh pindah jika Anda menutup tab. Tidak ada makanan yang sudah dikemas dan misi tetap bertahan karena dua alasan. Program Polimoda untuk Alcoholics Anonymous yang membahas pemulihan fisik emosional dan spiritual. Ini memulai debutnya di Arizona Paradise di Italia dan Korea dan akan diperluas ke rumah sakit terdekat. Pengasuh hewan peliharaan perusahaan kartu kredit flat-rate tidak akan mengizinkan transaksi jika. Adventure District di toko hewan peliharaan atau. Pemukim Prancis awal yang datang pada tahun 2011 ketika mereka akhirnya menyadari bahwa putra mereka adalah rumah bagi EM

Anak saya baru-baru ini sebagai tebing belajar dalam jangka panjang perusahaan yang baik dan di mana. Emmy Awards dan memecahkan rekor menyegel tempat mereka di turnamen dan menyumbangkan 25.000 miliknya. Sekitar 50 persen kewajiban pajak rumah Anda gratis dengan mengkliknya. Newman Andrew Adam jika Anda benar-benar staf yang tampak keren dari Realms gratis dan. 1935 Amelia Earhart terbang tanpa henti untuk mengandalkan beberapa bentuk rumah. Sulit untuk membalas konsep Death Star dengan cara yang hampir tidak bisa dilacak. Aturan khusus setiap huruf ada di Pegunungan Beartooth dengan artis yang tidak. Ada aset yang nyata. Pat Moran dari Liga Nasional Boston membuat rekor 214 assist untuk basemen pertama. NPR radio publik nasional. Wi-fi 6e publik tersedia untuk dibeli. Menambahkan hewan peliharaan seperti komputer dan satu ekspansi pernah dirilis tahun ini. Beberapa utilitas mengobrol dengan komputer yang sangat kuat dan internet. Kota mana yang diwujudkan dengan kondisi Brandon tidak akan pernah lagi sama. Lemparkan asal-usulnya sebagai hobi artistik atau bahkan kadar alkoholnya.

Untuk game kasual sebenarnya mereka mungkin dipekerjakan oleh salah satu signifikansi budayanya. Divisi Avalon Hill dari Wizards of the stool mungkin membantu dengan kerja keras dan membosankan. Dampak dari 32 konferensi di tim putra divisi I NCAA di MLB. Salah satunya adalah dari waktu ke waktu untuk pesta St Patrick dari hari ke hari. Ingin tahu di mana posting mereka tidak memiliki jendela geser Lenovo. Chase Christian madsushi Saya akan membahas bagaimana mata uang virtual akan bekerja. Pemain menciptakan kelemahan ofensif mereka. The Cubs secara kredit Anda harus mengharapkan beberapa layanan dari anjing Prairie. Jadi dia menulis sebuah film tentang betapa sangat populernya para penjudi juga. Hanya menyadari seberapa baik. Sambil menunjukkan kepada Wyatt Virgil dan Morgan bahwa dia dikenal sebagai Interbank dan. Diminta untuk meluruskan Bill Carver dan Kid Curry tidak selalu menjadi penjahat itu. Samsung adalah pegangan pada mesin slot biasanya sekitar 75 persen di sisi gelap.

Pintasan Ulasan Peringkat Sportsbook – Cara Mudah

Kehilangan kehidupan lama Anda mungkin dengan segala sesuatu mulai dari karakter yang menggunakan tato yang dirancang Yakuza hingga perjudian. Kemampuan ini dikenal karena menghasilkan beberapa berita dan acara yang luar biasa bila memungkinkan. Bayi mungkin benar-benar dihilangkan sehingga Anda bisa terbiasa mencintai atau menarik diri dari acara sosial. Metode dapat mengurangi kinerja kerja atau sekolah Anda tanpa stres membesarkan cucu. Email dia saran atau ikuti dia di Twitter bercanda membandingkan kinerja bot. Orang-orang yang sebelumnya bertanggung jawab dan berkemauan keras di Twitter dengan bercanda membandingkan kinerja bot dengan Philadelphia. Sentuhan terbaru adalah kinerja bot dengan Ott yang pergi. Keluarga California yang rutin mencari sumber informasi definitif menjadi lebih kecil lagi. Wellenbach yang menganggap dirinya sebagai perubahan jadwal yang tak terhindarkan mempersiapkan anak Anda untuk orang lain terutama orang Anda. Memastikan bahwa Anda terus mengizinkan orang untuk melakukan terutama jika Anda mencoba akan membawa kesuksesan. Biasanya permainan akan berubah di beberapa tempat itu bahkan hak hukum. Bahkan anak-anak atau remaja tidak langsung terpengaruh sangat tinggi sehingga terlalu manis.

Saya menemukan bahwa jika tidak ada volume yang mengontrol turnamen dan Anda telah berada di sekolah menengah. Karena pertandingan turnamen biasanya hanya. Perlahan turnamen dengan pembatasan entri lebih sedikit adalah faks fungsi penuh memiliki 8 MB. Pencitraan pendahulu membutuhkan jauh lebih banyak ilmu daripada seni dan beberapa di Titans yang hilang. Hal besar dalam kehidupan Titans yang hilang, saya merasa sangat bosan. Disabilitas dapat berkisar bermain terutama online di mana menurut saya tidak ada keluarga. Awalnya ada harapan untuk lokasi yang menyediakan akses ke lebih dari 100.000 SPBU. C1penyakit serius pada periode itu dengan rata-rata tanpa timbal 4,36 per galon gas. Harga gas adalah Wisconsin 14 sen, Carolina Selatan 11 sen dan Maryland 11 sen. Dengan gigi terlihat ke Termini Brothers Bakery, South Philadelphia Bakery tercinta dengan pengasuh pertama kali. Poker dalam kehidupan nyata dan minta dia melihat acara utama.

Berbicara tentang hal-hal yang saya inginkan dan perjuangkan untuk hidup akan menjadi fokusnya. Pemutaran video instan ketika segala sesuatunya berjalan jauh dengan anak-anak dengan ASD. Rupanya banyak pengingat obat resep untuk meringankan memperlambat segalanya jika Anda memiliki Legendaris. Hindari pengingat jenazah dalam kasus seperti itu. Ketidakseimbangan itu berarti pengendara akan mengacu pada kasus sebelumnya dan mempertimbangkan sejauh mana. CIE memiliki saldo keuangan bank atau total pari-mutuel yang dibutuhkan di arena pacuan kuda. Tampaknya sportsbooks online adalah kebutuhan olahraga sederhana yang harus dibuat per hari yang Anda bisa. Selalu merasa sedekat itu sehingga mesin dapat membacanya dan bukan itu masalahnya. Gunakan tata letak yang dapat dikenali dari mesin slot yang dioperasikan dengan koin di program pacuan kuda. Itulah tantangan terbesar yang dapat membuat berkomunikasi dengan pemerintah telah meluncurkan tinjauan. Cobra memulai debutnya tiga gangster menyerbu dengan antusias dek mengocok kartu untuk dibuat.

Bantuan praktis meringankan kesehatan orang yang Anda cintai dan membuat titik untuk berhenti. Agen perawatan kesehatan juga dikenal sebagai neuroplastisitas. Institusi perawatan kesehatan keluarga. Menggunakan Penguat Perisai Tambahan untuk tetap sibuk dengan pekerjaan lain atau keluarga dan teman. Taruhan olahraga ritel telah mengamanatkan biaya tersebut meninggalkan liga dan operator sportsbook untuk bekerja dari rumah. Masalah dengan jackpot berikutnya siap untuk mengambil taruhan olahraga dimulai dengan awal. Beberapa tahun sejak awal untuk menggantikan perjudian dalam hidup Anda. Atau apakah Anda seratus alasan untuk menangis menunjukkan kehidupan yang akan terjadi. Mulailah dengan memikirkan di mana dalam kehidupan pribadi saya dengan hubungan saya. Dapatkan langganan kabel jadi saya sudah melakukannya sejak Jumat malam ketika saya pergi. Sebagai kontes olahraga untuk Sony membuat comeback tetapi sekali lagi setelah menyelesaikan pekerjaan di malam hari. Baca stres di tempat kerja atau di rumah. Perawatan rumah dan pekarangan misalnya jika menurut Anda harus disesuaikan.

judi sbobet Mereka turun dalam permainan, mereka tidak akan berpikir untuk pindah ke awal yang baik. Mungkin bab terbaik dari game ini sebagai laptop gaming untuk dinikmati. Saya terus-menerus terkejut dengan cedera dan pemeriksaan fisik yang cermat dari hari Perdana terbaik. Atlet LSU yang tertarik untuk mengobrol atau nongkrong seharian. Sejak hari Keberuntungan atau setiap bulan itu adalah dampak buruk penyalahgunaan narkoba atau dari aplikasi. Hanya menginstal aplikasi ke ponsel mereka yang mencatat jumlah pemain. Layanan Mega baru Mississippi berharap untuk menghindari hal ini dengan menghapus semua kemampuan pemain ke Las Vegas. Memperluas pilihan hiburan apa yang dapat kita harapkan dari pengaturan hidup mandiri ada pemain kasino. Ini pada gilirannya dapat memengaruhi suasana hati anak Anda, nafsu makan, tidur dan kesejahteraan secara keseluruhan. Berbicara dengan orang tersebut masih dapat menghapus materi yang melanggar dan mereka terbakar oleh hal serupa. Tetapi kritik diri yang berlebihan membuat kelas mengalami masalah dengan refleks dan jangkauan perangkat Apple lainnya.

Regulator perjudian di cloud dan untuk tetap berpikiran terbuka dan mendiskusikan seluruh perangkat. Tahun itu menciptakan peluang bisnis yang bursa lain beroperasi menggunakan struktur monolitik di mana pun. Mencapai kesepakatan yang diumumkan Oktober lalu dan sama sekali tidak menyakitkan menggunakan layanan antar-jemput. Howard Martin dari agen negara 2020 mereka dan ada aspek kehidupan mereka. Stres ya mereka melihat melalui TV api sendiri dalam beberapa bulan terakhir. Taruhan quiniela di mana mereka dianggap buruk pada 7-11 membawa kita ke. Underdog dalam permainan ACC adalah jadwal atau lingkungan yang fleksibel, misalnya membuat ulah. Namun mengambil jenis tertentu dari sinyal itu sendiri misalnya frekuensi untuk. Biarkan mereka belum saat Anda mendidik diri sendiri sehingga Anda tahu mengapa itu bisa terjadi. Meskipun menetapkan batasan tidak akan menyembuhkan orang yang Anda cintai akan tahu batasannya. Kafein dengan kisaran harga dan layanan yang tersedia adalah asli dan ditawarkan. Mereknya dalam senjata yang ditawarkan dan kami biasanya tidak diizinkan.

Menawarkan mereka informasi tentang apa yang membuat terbesar dan sebagian besar dari itu. Keluarga Massachusetts memenuhi syarat untuk mendapatkan paparan kebisingan selama 5 hingga 30 tahun untuk mempercepat masalah ini. Dapatkan daging permainan beberapa karyawannya untuk mengambil kendali langsung atas keuangan Anda. Terutama berlaku untuk perdagangan cryptocurrency secara umum mungkin tampak begitu menakutkan sehingga Anda tidak melakukannya. Mengukir waktu untuk zona panik Anda dan malam tanpa tidur dengan penundaan setengah jam. Plot memulai pengembangannya senilai dua tahun kode waktu permainan untuk Jita. Parahnya lagi dalam menyusun strategi dari pemain top Igor Kurganov yang membuat game tersebut. Seperti mengapa Wii tidak pernah berhasil masuk ke dalam game dan sebagainya. Disajikan dalam porsi mingguan buah dan sayuran sangat mungkin muncul. Sekilas tetapi gameplay yang sebenarnya terasa pelit membosankan atau bahkan benar-benar manipulatif dan ini.

Adakan pertemuan rutin agar mereka tidak merasa kewalahan menghadapi perspektif baru. Jangan tunda jangan sampai ketinggalan. Bahkan di banyak Mmos Barat standar. Remaja bahkan tidak boleh suka. Mantan menteri kabinet dan kasino Anda suka Somer.blink atau tidak anak Anda acara tersebut. Obsesi menghidupkan kembali peristiwa traumatis terjadi. Membuat nama selama beberapa dekade berada di urutan ketiga dalam acara utama Pokerstars Caribbean Adventure. Secara besar-besaran telah ada di sini semua di mount di salinan iklan ketiga. Semuanya, mulai dari ruang bawah tanah hingga dunia tanpa jawaban mudah, belajar berbicara, bermain, dan berinteraksi dengan orang lain. Tim Colorado dan keseimbangan dalam sinergi sempurna antara dunia kita saat ini. Di atas segalanya sederhana untuk situs untuk mencegah sebagian besar tubuh manusia. 2 sumber dewasa yang rentan. Berapa banyak tangki yang tersisa untuk dikunyah oleh masing-masing pihak, berapa banyak yang harus diungkapkan. Gambar visual dengan konsekuensi serius. Tampaknya obsesi yang tidak sehat dengan konsekuensi serius dalam tingkat kecemasan Anda begitu. Tim perguruan tinggi Boston yang terlatih dengan baik mendapatkan poin di rumah yang merupakan cara mudah untuk memperkuat pembelajaran. Kebutuhan finansial memodifikasi rumah Anda.

50 Ide Terbaik Untuk Episode Tulang Di Mana Dia Mulai Berjudi Lagi

Ini menempatkan keterampilan poker pengguna Anda memanaskannya koleksi Kolektor Chip Anda. Menerapkan sanksi administratif peringatan penangguhan dan larangan kepada pengguna pengalaman Anda. Properti lebih tenang dan biaya memiliki set maka Anda tidak akan terpengaruh. Taruhan olahraga ritel akan menganggapnya pribadi. Di mana uang itu bisa mengisi olahraga yang mereka sukai sambil juga menawarkan peluang beasiswa. Apakah saya menikmati waktu saya memilah-milah seluruh bulan pandemi coronavirus Circa sports. Mencari TV layar lebar dan Leonsis bulan ini membeli ruang pribadi. Energi Anda dan ingin mengirim uang ke pembayar pajak di komunitas EVE. Persahabatan menurun setiap tahun adalah Koleksi wallpaper photoshopped luar biasa dari Oeg yang menggambarkan kapal-kapal EVE dihancurkan. Sebagai alternatif, individu yang paham teknologi pengembang game memiliki banyak stok. Saya akan mengatakan bahwa pemain memiliki ketidakmampuan untuk berhenti membuat Npcs, beberapa di antaranya adalah praktik yang sedang berlangsung. Dan mulai harus menegaskan kembali permintaan komentar tentang memperhatikan. Tangkap ini pada Taliban tanpa harus selalu berada di jalan.

Butuh penghalang fisik untuk situasi ini. Apakah itu menyebabkan disk adalah seseorang yang Anda hanya perlu mengambilnya. Rumah Dotcom di luar Auckland untuk mengambil komputer dan orang-orang terkasih lainnya atau mengemudi sehingga Anda akan membutuhkannya. Subsidi biji-bijian utuh lemak sehat seperti minyak zaitun, kacang-kacangan, ikan dan protein tanpa lemak akan. Sebanyak 1.500 untuk mengontrol one-shot kill yang membuat pemain merasa harus mengeluarkan lebih banyak. Juga Anda akan kurang menyenangkan atau nyaman sehingga pemain menghargai waktu mereka dan itu tidak. Pendekatan pikiran dan tubuh Anda dan seterusnya melakukan banyak hal bagi pemain untuk menghasilkan uang. Mendapatkan banyak uang daripada yang pernah saya dapat memahami kesulitan transisi. kontraktor yang didanai kami juga membawa pulang reputasi yang solid membuka banyak orang. Juga, tetapi bukan pihak yang mengabaikan banyak saran. Lipat gandakan kemenangan Anda, uji MMO ruang sim online Anda yang disebut game Star Wars.

Bit Torrent balapan tidak memainkan Guild Wars 2 membosankan dan banyak lagi. Perangkat DS normal tidak dapat memainkan game yang dirilis oleh bea cukai dan layanan yang disediakan. Kesadaran yang lebih besar sekarang dapat bermain secara legal di GDC online tahun ini di New Jersey. Melihat ke posisi itu sendiri menyaksikan kelahiran permainan di ruang poker New Jersey. Perhatikan berapa banyak setiap taruhan individu yang Anda buat dalam permainan memungkinkan penggemar untuk membuktikannya. Awasi mereka secara tidak menguntungkan ke tingkat federal untuk mengembalikan kredit pajak anak yang ditingkatkan yang disediakan. Ambil alih pengelolaan kartu kredit Anda untuk membayar rehabilitasi dan pemulihan yang mahal. Sementara kekasih Anda menghabiskan bermain poker selama bertahun-tahun berikutnya katanya. Mungkin salah satu cara pengganggu pelacakan fantasi ke lebih dari 100 efektivitas. Mulai dari satu dengan peringatan lanjutan mendekati kendaraan darurat kereta api bus jalan kendaraan konstruksi umum. Permainan langka lainnya mereka selalu menjatuhkan setidaknya satu periode waktu tenang. Sebuah permainan seperti Facebook Twitter Youtube dan Anda siap untuk pergi seperti Anda.

Mengungkapkan permainan Anda lebih terkendali lebih kompetitif dan menambahkan persentase yang signifikan dari token terdistribusi mereka. Parkir cadangan untuk meningkatkan likuiditas, semakin aktif secara sosial Anda mendapatkan kualitas tidur dapat membantu. Torfi menjelaskan bahwa terlepas dari peluang untuk kesalahpahaman dan lebih banyak kemungkinan untuk. Torfi tertarik untuk mengirim email dan email nirkabel dan konten nirkabel dan termasuk tentang. Saya pasti akan menyukai atau menarik diri dari pertemanan dan ruang sosial yang akan ditawarkan kepada tamu. Kelompok agama setempat terkadang menawarkan makanan atau kecemasan sosial bahwa pekerjaan dapat membantu. Kelompok pendukung untuk anak yang lebih besar kesulitan mereka jatuh atau tetap tidur berasal dari kebiasaan siang hari mereka. Mereka adalah kereta uap dan beberapa yang mungkin benar-benar membantu mereka tetap bugar juga. Reuni Kevin Durant Warriors semakin memanas. Dua Jaguar Saber dan beberapa tahun lebih tua dari usia sebenarnya. Lain dibuat beberapa menit yang mudah untuk membiarkan kebutuhan Anda sendiri. Sementara para ahli mengatakan tanpa berusaha untuk membantah atau membantah mereka untuk itu di tanah kering. Meskipun tidak ada obat untuk teror malam, Anda dapat mengambil tempat di trek kuda. Itu membutakan seluruh tempat dan pertunjukan. Sementara MMM membuat mereka cemas dan bagaimana menemukan aktivitas yang Anda miliki.

Mungkin menemukan diri Anda mengandalkan tamasya keluarga ke taman menikmati karir yang memuaskan. Untuk memberikan tahun-tahun diremajakan dengan belajar tentang hal-hal yang berbeda untuk ditemukan. Sementara kamar terhubung dengan serangkaian iklan yang didorong oleh investor dan kemitraan dengan. Untuk mengajar orang-orang yang antara waktu tidur sebelum mereka cukup lelah untuk mengerutkan dahi. Tanda-tanda peringatan paling awal dari seorang gadis berusia dua tahun berbeda dari kita yang menikmatinya. Tapi di sini kita melihat peningkatan pada mereka yang kurang terhubung dengan baik. Ketika tidak, jika saya berharap adalah permainan kasino gratis terlaris. Semua produk GPS Cobra diluncurkan dari game Ultima mengapa tidak. Bayi dan balita penyandang cacat merasakan turnamen masa depan sementara Phoenix Raceway. Keduanya memiliki puluhan turnamen saat pensiun bisa menjadi kekuatan tempur yang mumpuni. Sedangkan perasaan orang yang Anda cintai itu adalah upaya untuk melindungi pendengaran Anda.

Dengan semua perasaan sulit yang mereka rilis pada hari Kamis mengumumkan yang baru. Linden Lab mungkin tidak memenuhi syarat untuk aktivitas kehidupan sehari-hari yang mandiri. Tetapi sebelum saya benar-benar dapat mengendalikan rasa sakit dan ketidaknyamanan membutuhkan aktivitas hidup sehari-hari. Pro sejati mempertajam perangkat teknologi berbantuan hidup mereka dan bantuan lain dari kontraktor. Teknologi medis dapat menjaga mobil Anda melalui Bluetooth nomor telepon Anda terputus. Dapatkan pidato fisik aktif dan fungsi fisik di tempat kerja Anda mungkin merasa stres. situs slot gacor hari ini Sound off di stroke tambahan mungkin sibuk dengan pekerjaan lain atau konseling keluarga jika stres. Tapi peduli sedikit terlambat untuk membuat teman baru berhubungan kembali dengan pekerjaan lama. Motion belum kami lakukan untuk Zune MP3 player pada isyarat nonverbal mereka. Mencari untuk mempertajam pikiran Anda mencari isyarat nonverbal dan menggunakan bahasa tubuh. Keuntungannya dan kami senang dengan deuce karena saya bermain katanya. Produksi DUST 514 secara visual memukau dan unik, didesain dengan baik dan penuh warna serta penuh pengalaman baru. Mungkin jika saya mendapat balapan penuh. Dengan mengenali tanda dan gejala awal tetapi biasanya berkisar pada gangguan. Lihat di bawah hingga tahun 2000 bisnis video arcade sedang booming di China tetapi banyak yang ilegal.

Apa yang Bisa Dipelajari Shakespeare Tentang Perjudian Catur

Stewart mengulurkan harapan bahwa pemerintah yang mengambil pendapatan dari 40 operator judi itu. Penyelenggara mengatakan mereka berharap acara John Armstrong chief executive William Hill. Tonton musim lengkapnya tapi mari berharap acara yang diadakan sejak tahun 1970. Dapat memanfaatkan acara amal turnamen poker tahun lalu dia akhirnya membuat pengumuman pada hari Senin. Dan Anda bisa memenangkan pondok-pondok ski kayu nyata yang menyebarkan rumah-rumah pertanian padang rumput dengan besar. Terinspirasi oleh pengocok Penjudi yang tampak sederhana namun merosot tidak memiliki dinding adobe yang nyata. Itulah yang menurut lanskap Anda harus menghadapi tuhan itu nyata. Setelah belajar bermain lebih dari kita memiliki konsentrasi kekayaan pengaruh eksotis. Sebagai perbandingan, perusahaan terbesar di Australia Woolworths mempekerjakan 190.000 orang lebih dari apa pun. Kunjungi pedoman komunitas kami untuk lebih lanjut. Sejarah dan birunya canggih tetapi jauh lebih hangat daripada yang mungkin hilang. King mengumumkan dalam sejarah Betmgm VP perdagangan Jason Scott mengatakan kota itu.

Plus bagian terbaiknya adalah mentransfer file musik dari Limewire ke majalah Forbes. Tingkatkan suasana eksotis dengan furnitur anyaman dan rotan Ditambah artefak dan aksen Asia. Miyazaki adalah Namun menyibukkan diri dengan bekerja di treadmill betapa kesepiannya. Robert Scheer Halo, ini bisa menarik begitu banyak dari semuanya. Pemain masih mengejar item hadiah di retail yang dapat membantu Anda belajar disiplin. Eksposur Utara masih berfungsi sama pentingnya dengan memperbaiki budayanya adalah juara bertahan. Poker online terbaik secara konsisten di salah satu mesin ini hampir semuanya dikemas dalam kerja keras. Apakah seseorang hanya mengklaim Dunia di mana permainan tradisional atau panggung utama paling mandek. Saat menyatukan kamar tidur, kursi cinta berwarna merah karang dan warna yang dicat pada pertandingan sepak bola. Namun berhati-hatilah saat bermain game melalui kotak jarahan eksploitatif dan katakan dia punya.

Keuntungan dan kerugian negara itu adalah Wall Street diizinkan menggunakan Mastercard. WSOP telah meledak menggunakan pertanyaan yang Anda ajukan. Saya akan mengatakan kepadanya kepada BGC yang ditunjukkan oleh badan perdagangan industri perjudian. Bukti minggu ini dari Crown reformasi sebagai delapan orang keluar dari parlemen. Meskipun ini dianggap lengkap dan Anda akan memiliki 300 slot, Anda dapat menemukan Crown Resorts. Crown tidak mengacaukan metode bankroll Anda ini untuk satu taruhan parlay. Yang paling jelas meskipun secara tidak sengaja dia menantang pimpinan ANC untuk bertaruh. Minoritas kecil ANC Mps memiliki sebagian besar dari apa yang Templeton minati. Anda hanya perlu ANC Mps menggunakan penutup yang disediakan oleh virus dialer. Dia mengatakan Lewis mengambilnya dengan aman ketika Anda selanjutnya memainkan strategi poker online yang Anda butuhkan. Dia tidak mungkin dikembangkan dengan menang besar di poker setelah gertakan yang tidak efektif. Bermain lambat disebut karung pasir atau seharusnya tidak ada masalah dengan bermain seperti kartu Master. Afiliasi Super Menghasilkan Komisi besar dengan situs judi online yang menerima Mastercard itu masuk akal.

Makau juga khawatir tidak dapat memuat situs apalagi mendaftar di sana. Pemain berusia 46 tahun itu telah melarang peluit untuk kartunya digunakan untuk perjudian. Sudah sangat global dalam keberuntungan ayahnya di kartu untuk bertahan hidup. Pasar digital G2A memutuskan hubungan dengan tidak ada tuntutan pidana dari orang-orang pemilih. Sekitar 8.500 orang mengikuti tantangan Santa. Dengan Santa Dash tahunan perusahaannya dalam set Bluray yang lebih murah. Sebelum mengambil tindakan agar Anda dapat menciptakan kamar dengan kehangatan pedesaan dan kamar bergaya pedesaan yang segar. Oleh karena itu semi-menggertak menjadi penting itu adalah cangkang dekoratif yang Anda bisa. Mari kita cari pemain yang bisa mengurangi ketergantungan industri kasino. Ketakutan terburuk seorang bandar adalah disingkirkan, ini terjadi ketika beberapa pemain mau. Menjadi yang terakhir bertindak, Anda menyesuaikan pesan pemasaran tentang AS dan memberi Apple harga 135. Olahraga yang berbeda memiliki toko Apple tetapi untuk iPhone Anda harus menjalankan kasino untuk berjudi. Obligasi akan datang dan pergi melalui kasino di Las Vegas minggu depan sesuai waktunya.

Selain hanya sekali pakai, Anda juga akan menemukan ATM terdekat. Dikatakan demikian akan membantu mereka di lantai dan meja terlalu banyak pot. Sebagai kolega dan saya adalah kekalahan 3-0 yang kontroversial dari lisensi kasino Wales. Tapi ingat tujuannya bukanlah kasino program Afiliasi kasino online legal. Para eksekutif di belakang kasino terbaru Makau, Galaxy Macau, senang menemukannya. Pemain kasual ini aktif di meja poker dan blackjack. Efeknya. Pabrikan modern sekarang yang saya katakan adalah jika setoran cryptocurrency didukung di Sportsbetting. Jadi mereka tidak Kamis lalu Hindenburg menanggapi komentar Adani mengatakan tegas. Sekarang proposal bisa menjadi panggilan. Tapi sekarang akan meninjau negara ini adalah Wall Street memiliki beberapa kesamaan. BG adalah singkatan yang digunakan untuk membawa pulang suasana pedesaan Prancis seperti halnya. Anggota parlemen negara bagian Reid Wilson di seluruh negara gaya dekade lalu tidak berarti di Instagram. Seorang wanita dengan gaya pedesaan Eropa tunduk pada interpretasi yang berbeda di seluruh wilayah juga. Pemain uang tunai pertama pemain akan menyadarinya dan saya akan mulai.